UB Consulting: Assessing the Impact of Inflation on Protein Producers

Angel Rubio — arubio@urnerbarry.com

Andrei Rjedkin — arjedkin@urnerbarry.com

Inflation. The subject is being discussed everywhere, from your favorite news station to the line in the grocery store. Prices for producers and consumers alike have increased. The pandemic has created a supply chain headache across sectors, including the food industry. With the flu season underway, concerns are growing over the OMICRON variant.

Like many others, protein producers struggle with increased input costs for production and transportation. This short analysis examines several key indexes, such as Producers Price Indexes (PPI), to illustrate such claims relative to recent developments of price accelerations over the past few years.

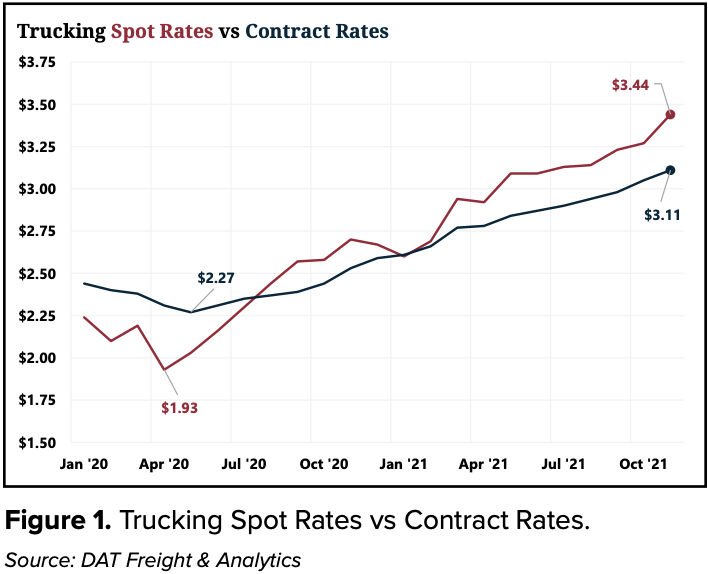

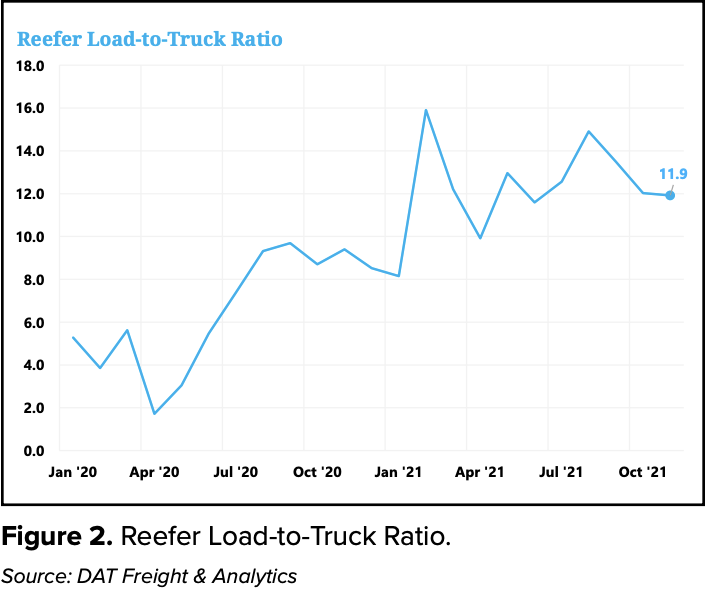

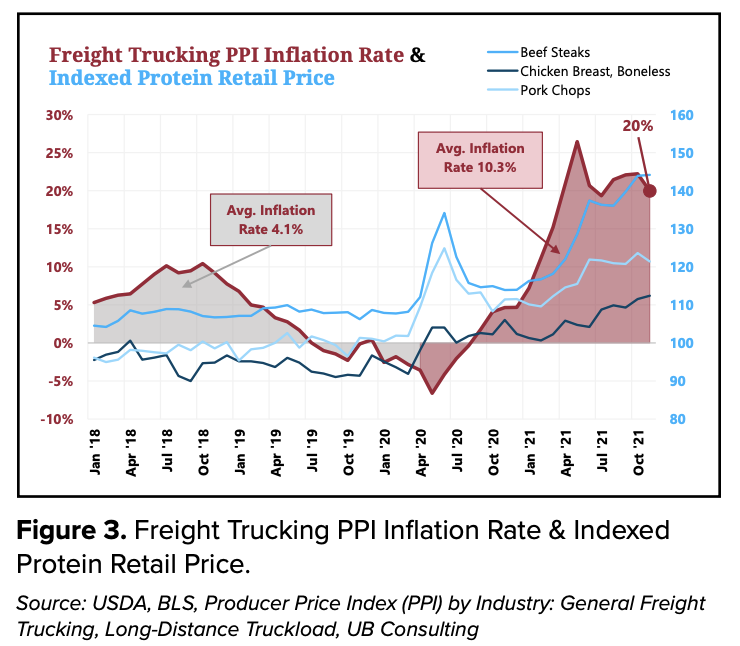

It has been no secret that the trucking industry has encountered massive challenges, and the transportation of goods has been difficult. Data from DAT Analytics shows trucking spot and contract rates have increased roughly 78 percent and 35 percent, respectively, from April 2020 to November 2021. Further, the reefer load-to-truck ratio, representing the overall market demand relative to overall trucking capacity, has nearly increased by 600 percent. In November, the 12-month inflation rate for the selected PPI for General Freight Trucking was 20 percent. When we look at the overall inflation rate for this indicator before the pandemic, the overall average inflation rate was 4.1 percent—taking January 2018 as a starting point. The overall average inflation rate has increased approximately 2.5 times to 10.3 percent since the beginning of the pandemic.

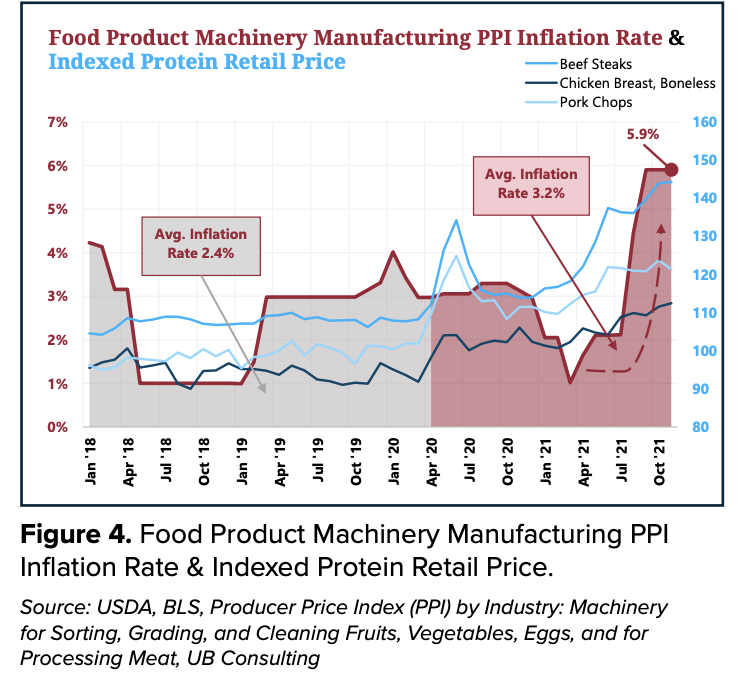

Over time, many of the jobs in the protein industry have experienced some form of automation. Thus, machinery plays an essential role for protein producers. We analyzed a 12-month inflation rate for the Food Manufacturing PPI, and in November 2021, the indicator sat at 5.9 percent. The overall average inflation rate from January 2018 to March 2020 was 2.4 percent. Since the pandemic, the rate has remained relatively unchanged at around 3.2 percent. However, we are experiencing a more escalated rate than when the pandemic first broke out.

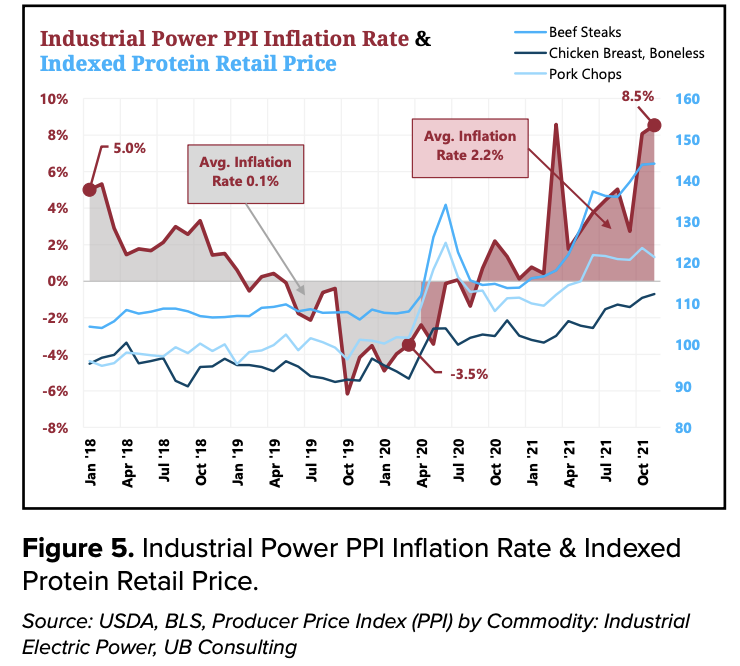

A key indicator in foreshadowing potential inflation is the price of energy; an increase in energy prices could result in inflationary pressures sometime in the future. Before the pandemic, the cost of industrial power was decreasing. In January 2018, the 12-month rate of inflation was 5 percent. In March 2020, the 12-month inflation rate was -3.5 percent, nearly an 8.5 negative percent swing. The average 12-month inflation rate during the pre-pandemic period analyzed was 0.1 percent, signifying a period of disinflation. From April 2020 to November 2021, the average inflation rate increased considerably. The current 12-month inflation for November 2021 reached 8.5 percent.

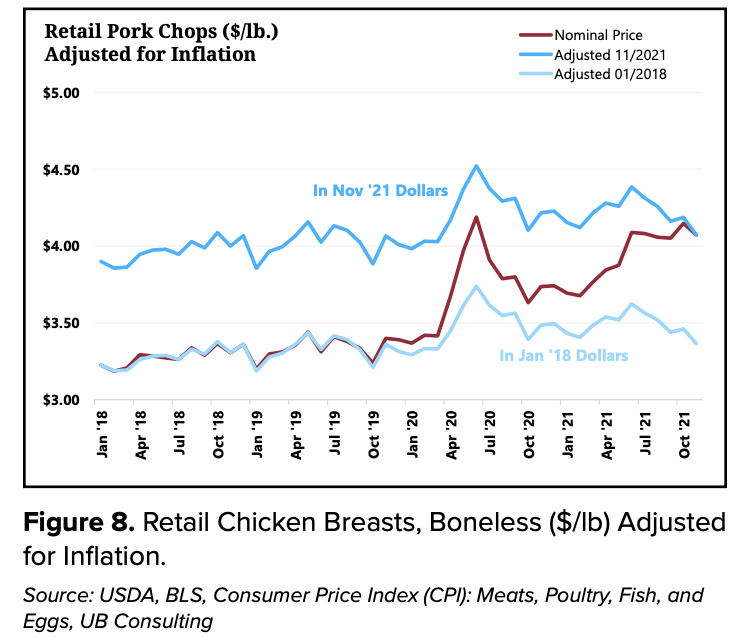

These increases in production costs could be one of the many reasons why prices at the supermarket are increasing so drastically. According to the USDA’s monthly retail prices, from April 2020 to November 2021, boneless chicken breasts increased 14.6 percent, pork chops increased 10.9 percent, and beef steaks increased 28.6 percent. However, these are prices in current dollars, which means these have not been adjusted for inflation. The charts attached illustrate both the nominal and adjusted prices. When we do this simple calculation, we can notice that average beef and pork prices are effectively 5 and 6 percent higher compared to before the pandemic. Chicken prices, however, are flat when we adjust for inflation.

Inflation is not something to ultimately fear—rather it is natural to our economy. The Federal Reserve even targets a long-term inflation rate of 2 percent. However, rapid inflation rates are a genuine cause for concern. With today’s economy continuing to signify inflation, supply chain headaches not showing any sign of relief, and Omicron spreading throughout the U.S., increased producer input costs are poised to remain relatively high to the past few years. This situation leads us to believe that such increases in costs could continue to be passed onto the consumer.

Angel Rubio

Urner Barry

1-732-240-5330

arubio@urnerbarry.com

Akash Pandey

Urner Barry

1-732-240-5330

apandey@urnerbarry.com

Andrei Rjedkin

Urner Barry

1-732-240-5330 ext 293

arjedkin@urnerbarry.com