UB Consulting: U.S. Sanctions on Russian Protein Trade—What Does It Mean?

Angel Rubio — arubio@urnerbarry.com

Andrei Rjedkin — arjedkin@urnerbarry.com

The Russia-Ukraine conflict has created ripple effects throughout the global economy—impacting the price of corn, grains, fertilizer, oil, and more. As the conflict persists, countries and companies around the globe have sanctioned various divisions of the Russian economy in hopes of accelerating peace talks.

President Joe Biden has targeted Russian energy — banning all U.S. imports of Russian oil, liquefied natural gas, and coal. Most recently, an executive order was established banning all imports of Russian fish and seafood. Talks surrounding the ban of imported Russian seafood began on February 9 when Senator Dan Sullivan (R-AK) and Lisa Murkowski (R-AK) introduced the U.S. Russian Federation Seafood Reciprocity Act to the Senate.

Many countries rely on Russia to fill a portion of their protein demand. As countries look to implement more aggressive sanctions, how might the global economy react? In order to answer this question, we must dissect the global protein trade with Russia.

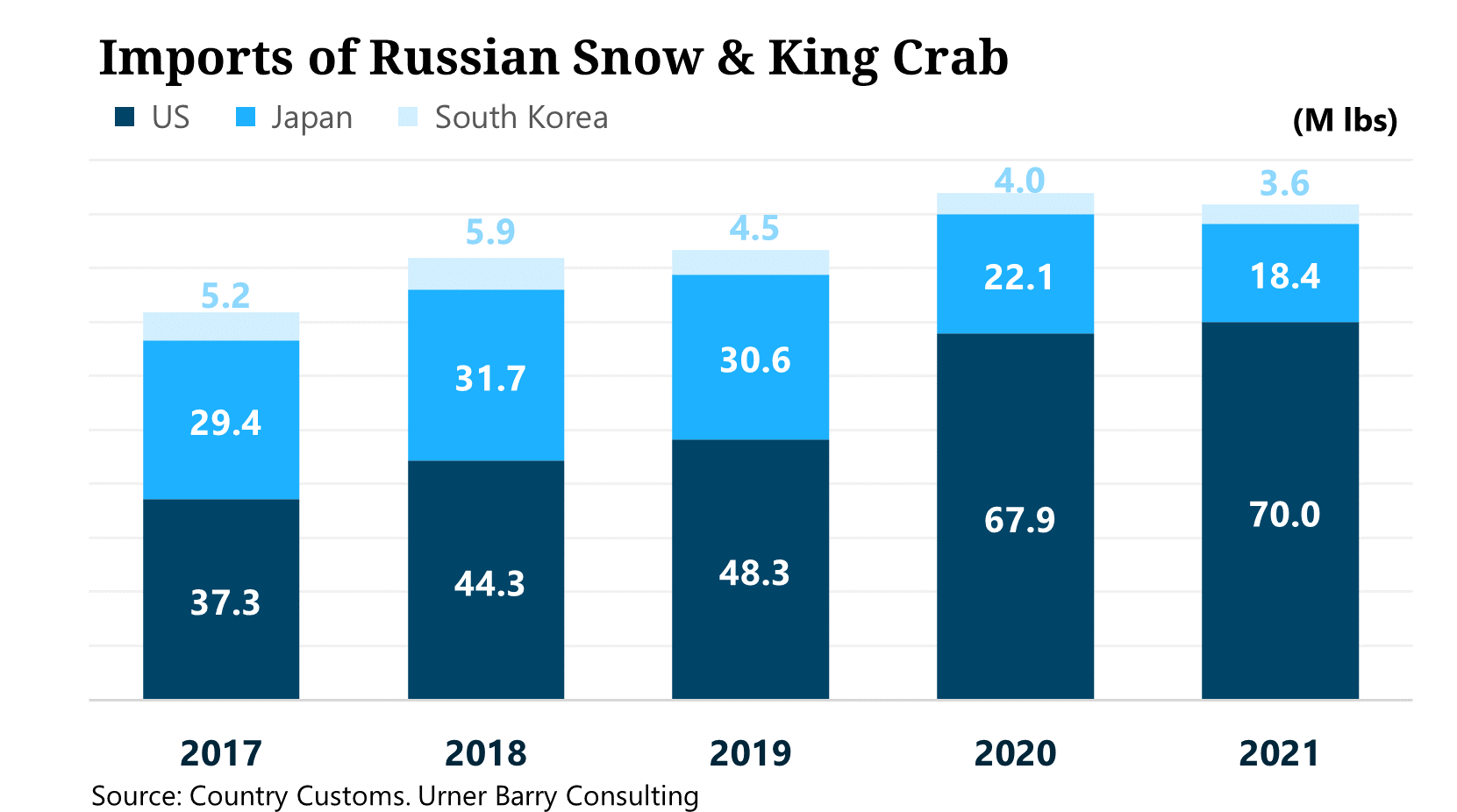

Currently, Russia remains a major player in the snow and king crab market. In 2021, the global economy imported roughly 94 million pounds of frozen snow and king crab from Russia — of which the U.S took nearly 70 million pounds. From 2017 to 2021, the U.S. represented roughly 61 percent of global imports from Russia — equating to nearly $3.4 billion. Following the U.S. was Japan with 132 million pounds and South Korea with 23 million pounds — representing a value of $1.4 billion and $164 million, respectively.

The current market already prices these commodities near record-highs. The February 2022 Urner Barry Snow crab 5-8 oz cluster quote for Russian crab sat roughly 76 percent above the previous 3-year average at $16.34 per pound.

In comparison, Canadian snow crab averaged $16.52 per pound. Canada is regarded as the main supplier for the U.S. in the snow and king crab market. In 2021, the U.S. imported roughly 101.8 million pounds of snow and king crab—representing nearly 91 percent of global imports from Canada.

Snow and king crab are considered premium products. With prices already near all-time highs, the new government sanction could cause a significant shock to the supply side, ultimately making it a difficult task for producers to obtain additional quantities, as we already take in a significant portion of Canadian product. If prices continue to hover around all-time highs or even spike further as supplies tighten, consumers and producers may rely on other, more attractive substitutes.

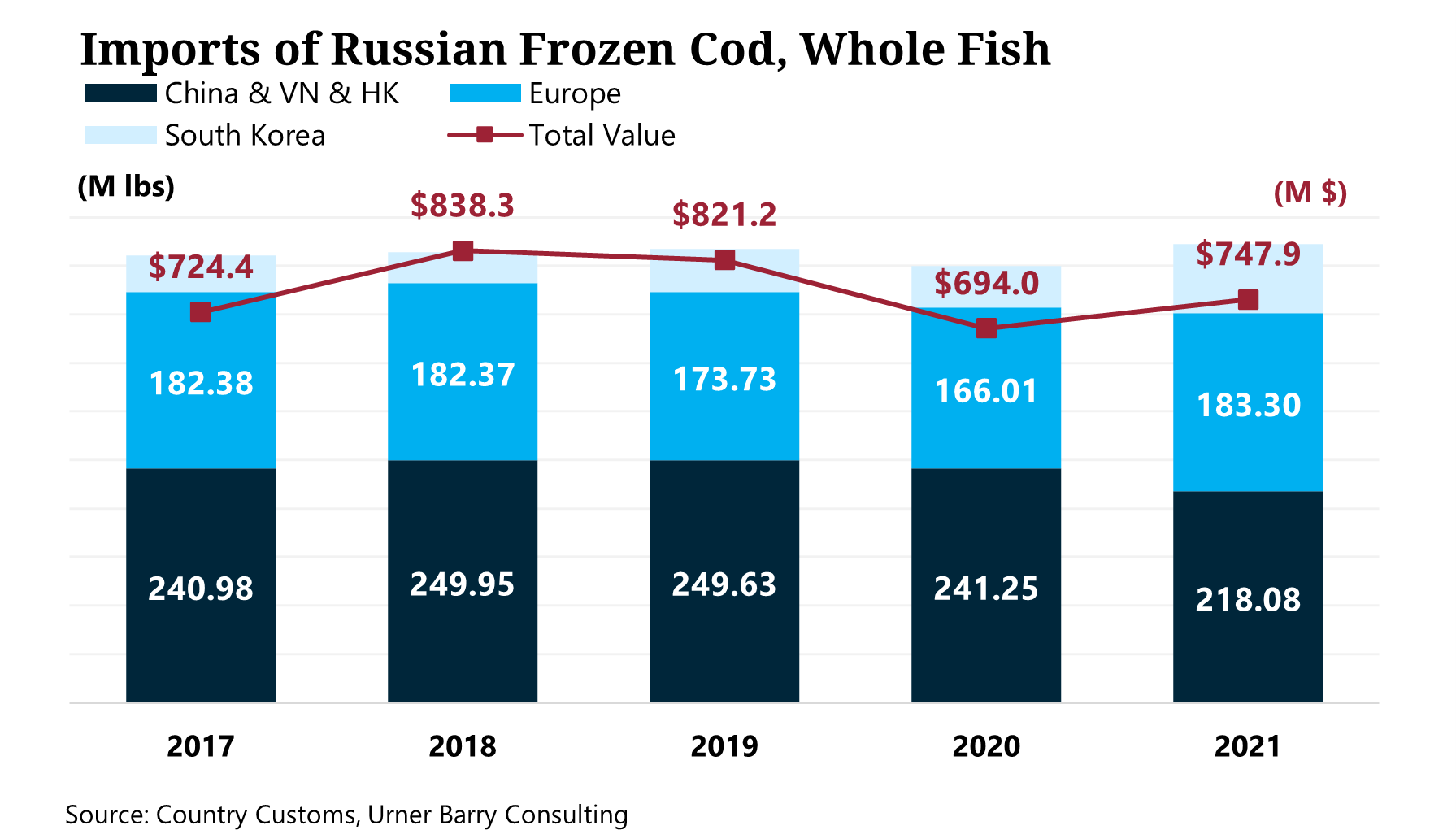

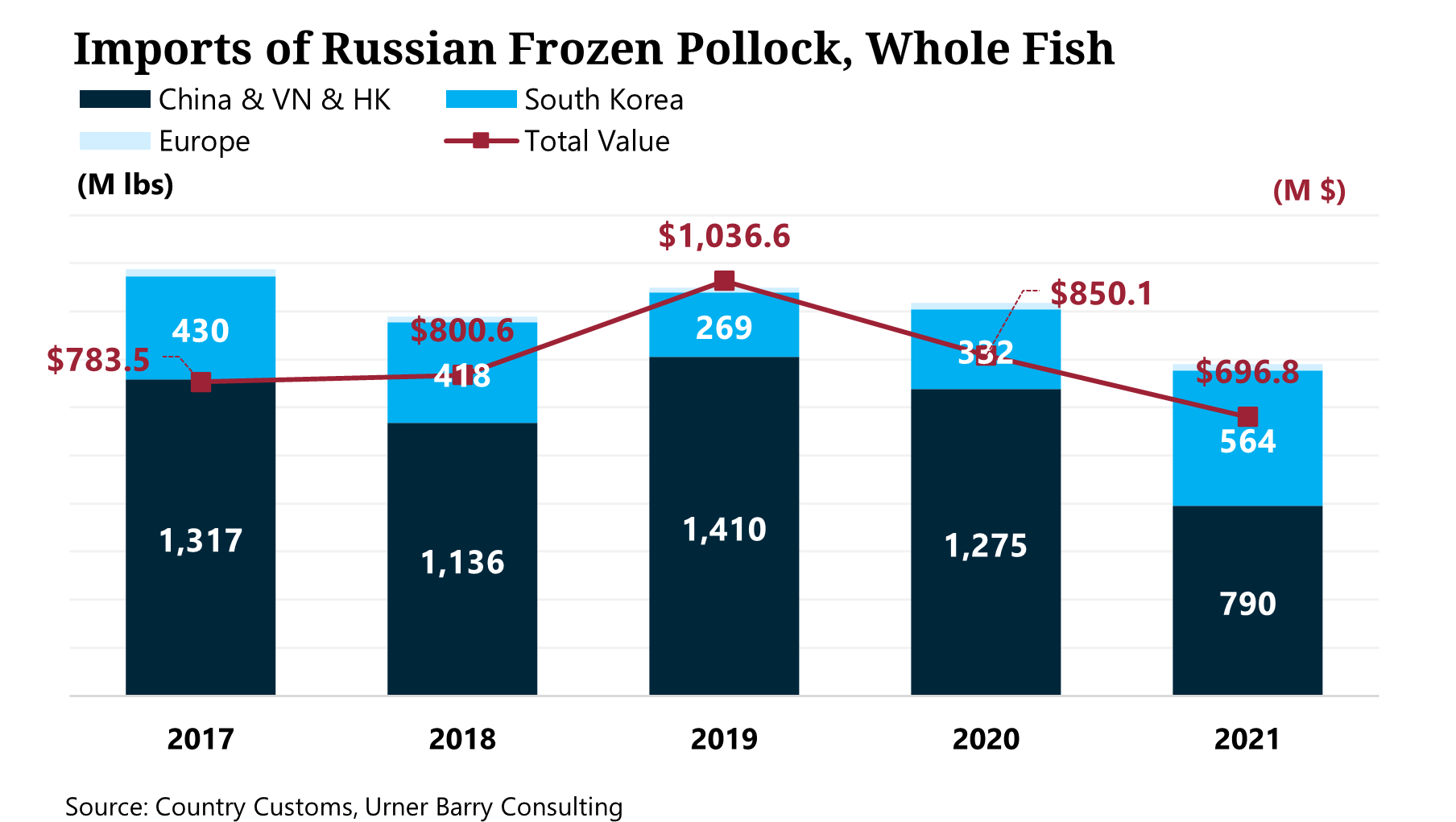

Russia also remains a significant player in the cod and pollock markets. China, Vietnam, and Hong Kong imported the most frozen whole fish product from Russia. From 2017 to 2021, the region imported 1.2 billion pounds (544 thousand MT) of cod and 5.9 billion pounds (2.7 million MT) of pollock. In terms of value, imports of cod and pollock totaled approximately $5 billion during this time frame.

Much of this frozen whole fish purchased by China is further processed, filleted, repackaged, and sent to other countries. From 2017 to 2021, nearly 80 percent of all U.S. imports for frozen cod and pollock fillets come from China. Although unclear, if the U.S. were to implement sanctions on these commodities, it is not unreasonable to see a domino effect in seafood prices in the U.S. market.

According to the Urner Barry double frozen quotes from China, cod and pollock fillets are already at record highs. Any further pressure on supply could drive prices even higher, holding all other variables constant.

_3.png)

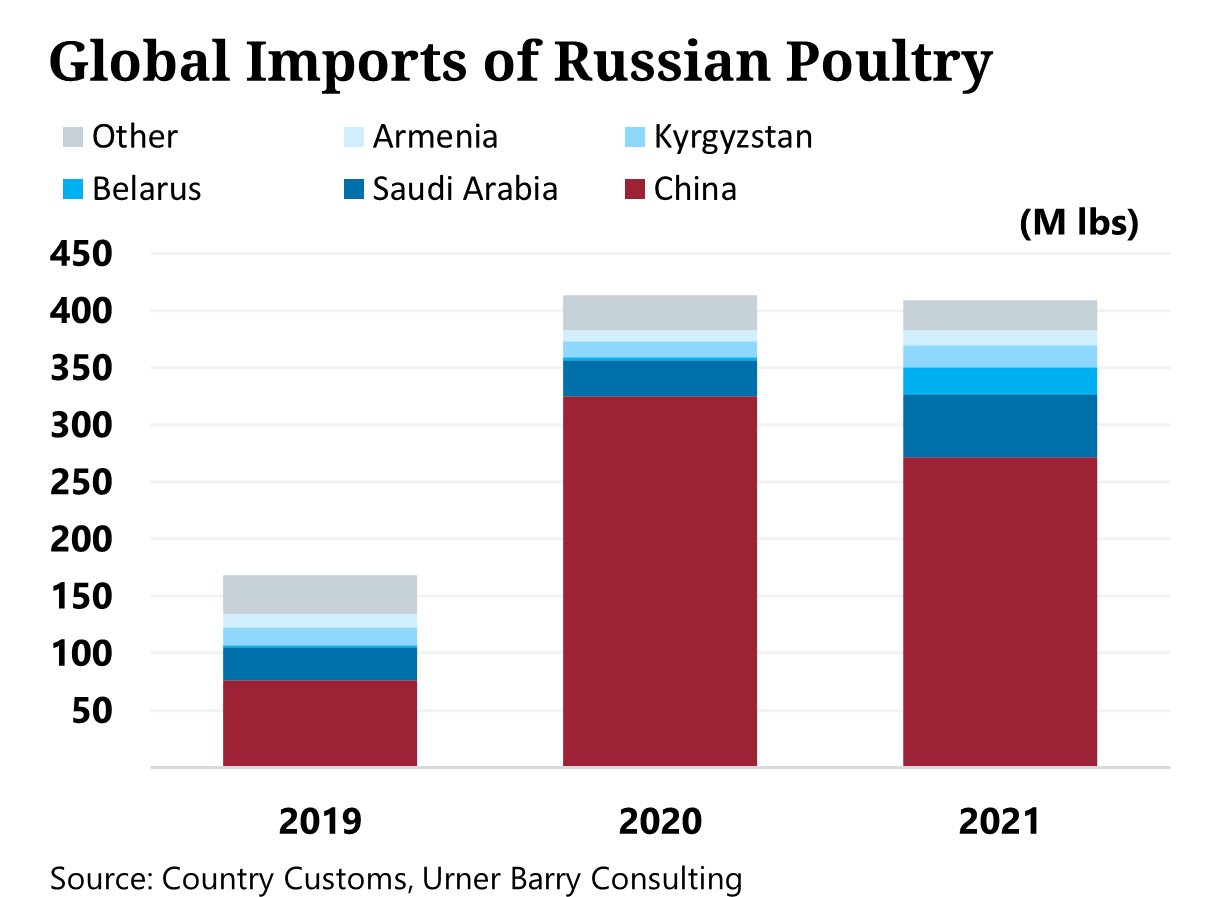

Many countries also import Russian poultry. From 2018 to 2021, global imports of Russian poultry increased by 143 percent. Within the past three full years, China represented nearly 68 percent of global imports from Russia, equating to nearly 673 million pounds, followed by Saudi Arabia and Kyrgyzstan. Any unlikely sanctions from China could disrupt the global poultry trade.

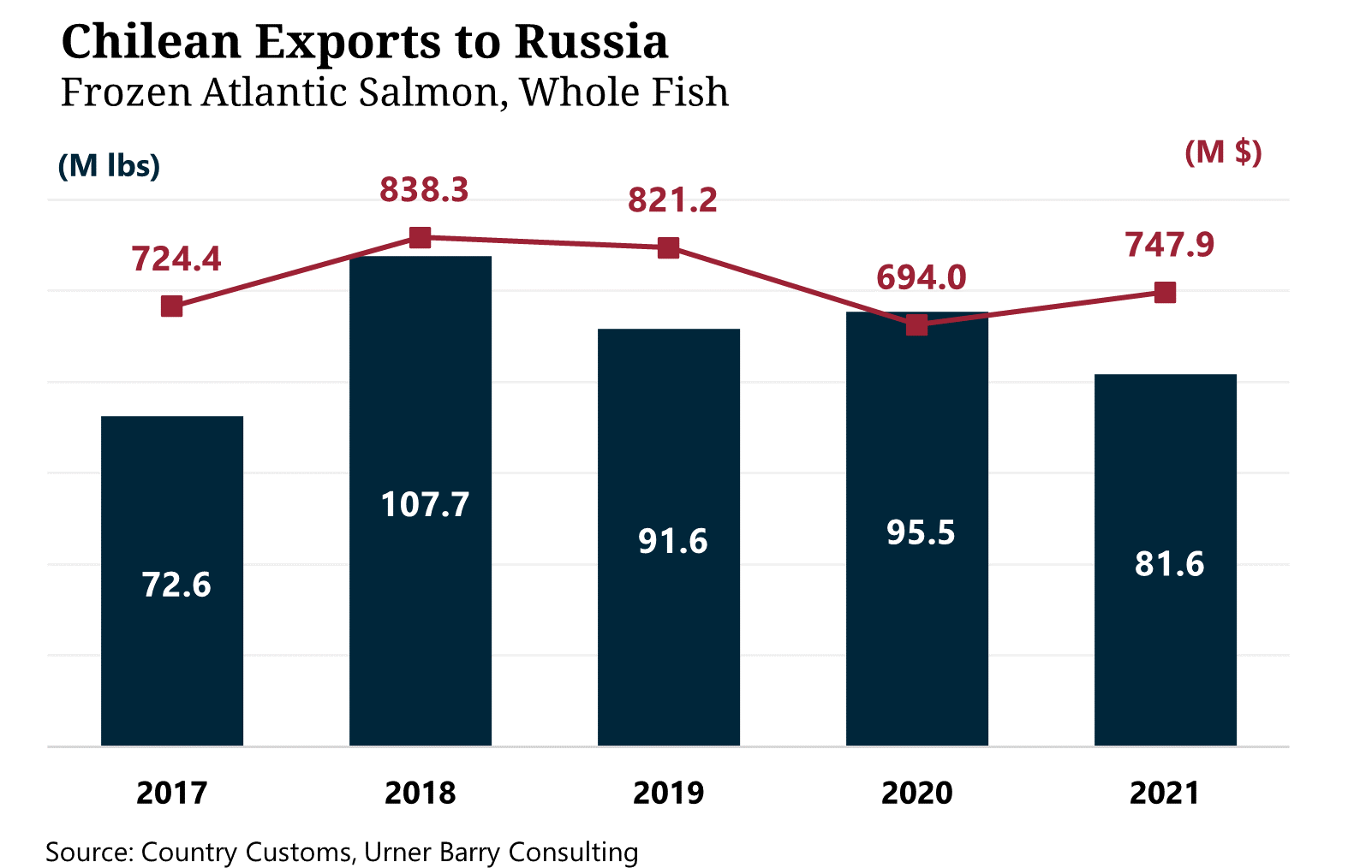

Regarding exports to Russia, South America has played an essential role in the red meat, poultry, and seafood markets. Chile exported the most frozen whole fish Atlantic salmon to Russia. From 2017 to 2021, nearly 456 million pounds were shipped — a value of approximately $1.26 billion. Any potential sanctions made by Chile or Russia could divert this trade to other countries. If market conditions were attractive enough, countries like the U.S., China, Brazil, among others, would be destinations for such surplus.

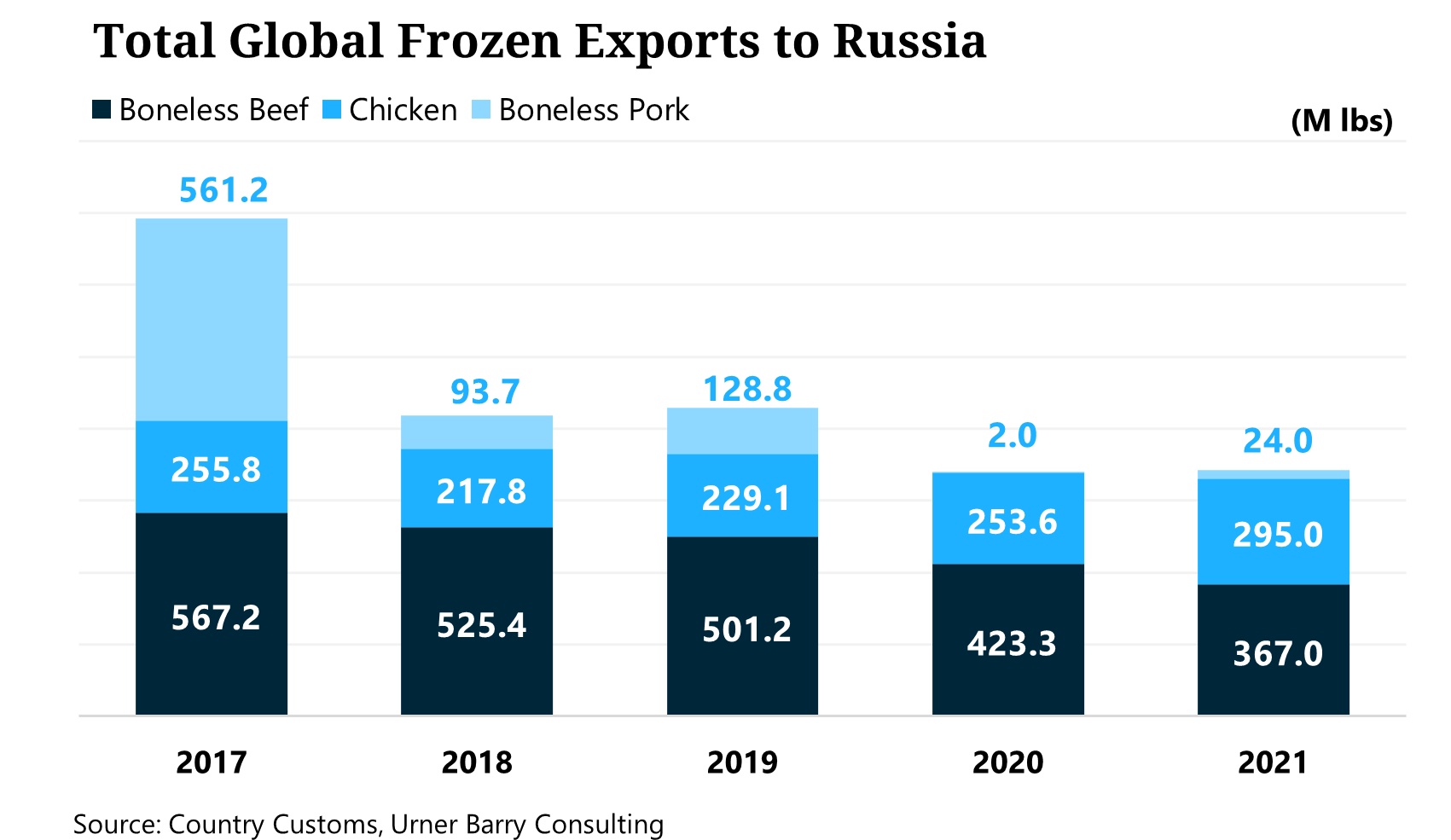

Even though frozen beef, chicken, and pork exports to Russia have decreased significantly over the last couple of years, South America has continued to export the most product. From 2017 to 2021, Paraguay exported the most frozen beef to Russia, followed by Brazil and Belarus. During the same time frame, Brazil and Chile exported the most frozen pork. For chicken—Brazil, Belarus, Argentina, and Paraguay shipped the most frozen product to Russia. If any of these countries implemented sanctions, the surplus product could be sent to other destinations. In the case of beef, the U.S. currently has import quotas for products coming from several countries in South America. Countries like Brazil have nearly hit their quota for the year. Any further trade to the U.S. would result in additional taxation. To avoid this scenario, countries may send their product elsewhere.

For countries that have not interrupted trade with Russia, doing business with Russia may become a difficult task. Since the war began, sanctions have led to the ruble's devaluation, leading to uncertainty on whether or not Russian goods could even be supplied to destined markets.

On the U.S. retail side, country of origin labeling (COOL) may become an issue for current product holders of Russian goods. For example, retail demand has been strong for many protein items over the last couple of years. Consumer and retailer sentiment on the war may have already shifted preferences, ultimately affecting the demand for any of these goods. Cooked crab product does not need to abide by COOL rules unless it is prepackaged. Nonetheless, some major retailers like Costco have already stopped buying Russian seafood.

Although foodservice does not require COOL, the sentiment from many users could be similar and may avoid Russian-origin product, even if prices were relatively attractive.

All in all, any sanctions implemented on the protein market would create significant supply shocks to the global economy. This short exercise, which only uncovered the tip of the iceberg, has taught us that global markets are deeply intertwined. A sanction from one country could have a possible domino effect on others. The Urner Barry consulting team will continue to monitor the situation, and any additional impact sanctions could have on the market.

Photo Credit: Daboost / Shutterstock.com

Angel Rubio & Andrei Rjedkin

Urner Barry

1-732-240-5330

arubio@urnerbarry.com; arjedkin@urnerbarry.com