UB Consulting: The Rise of Salmon Prices Compared to Other Proteins

Thursday, 03 March 2022Simple fundamentals like higher imports and steady to firm wholesale prices can lead us to quite safely state that salmon demand has strengthened over the last several years; granted, there are very few immediate substitutes for salmon. However, items with comparable price points, such as beef steaks, are empirically known to compete at the retail and foodservice level. During the pandemic, many steaks saw significant price increases compared to many other proteins like chicken, pork, and seafood due to a host of reasons. Among them are supply disruptions and higher consumer incomes that caused a shift in demand towards higher-priced or “premium” items, as perceived by the consumer. Salmon, however, did not experience such price hikes until the second half of 2021 and through 2022, while at the same time, beef prices began correcting downward. So then, can the price differential between these two proteins be a relevant factor for buyers?

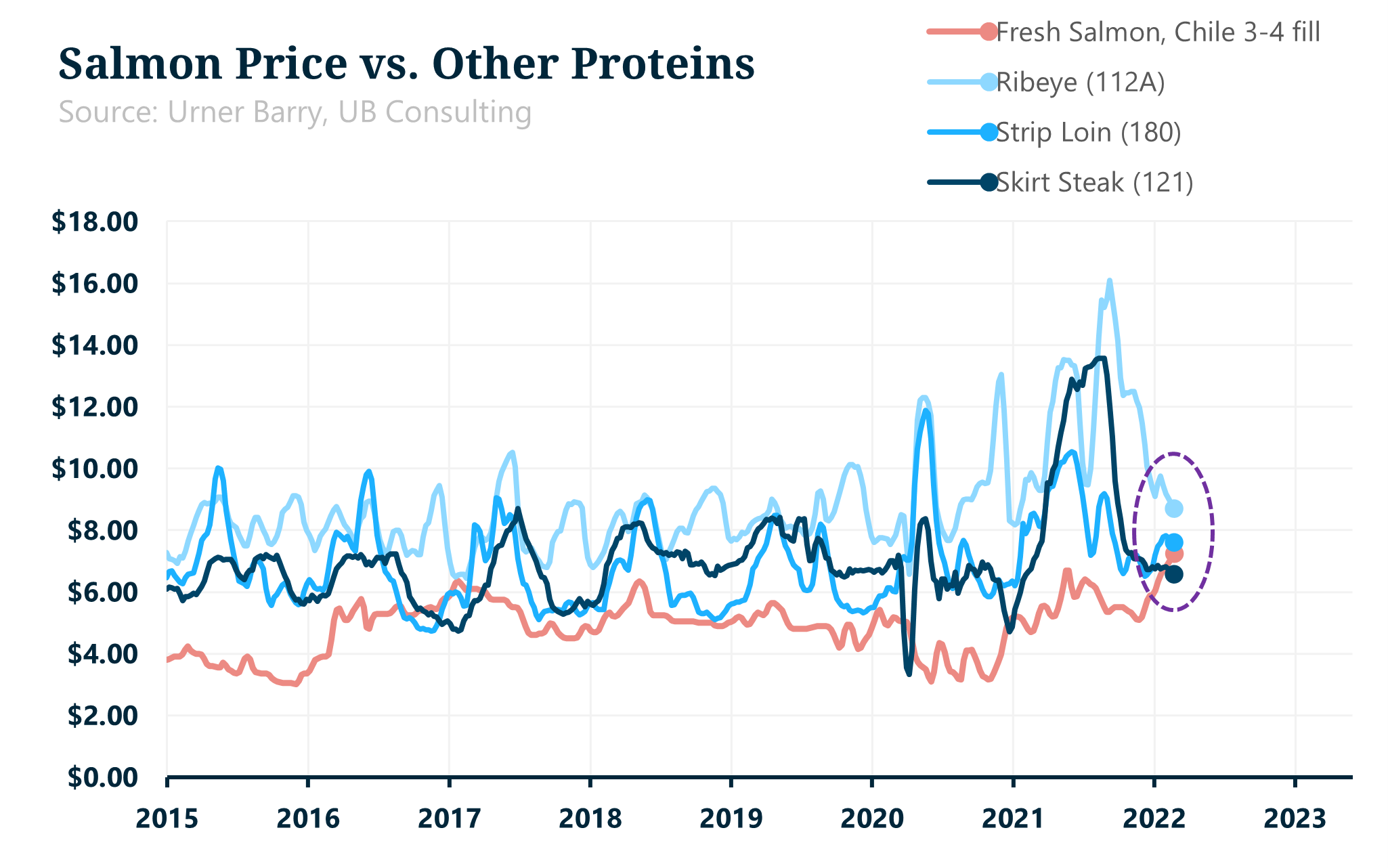

We initially looked at these items in nominal prices and their relationships. In other words, we took wholesale prices of fresh Chilean salmon as a benchmark relative to three cuts of beef; the ribeye, the strip loin (known as NY strip steak in many parts of the country), and skirt steaks.

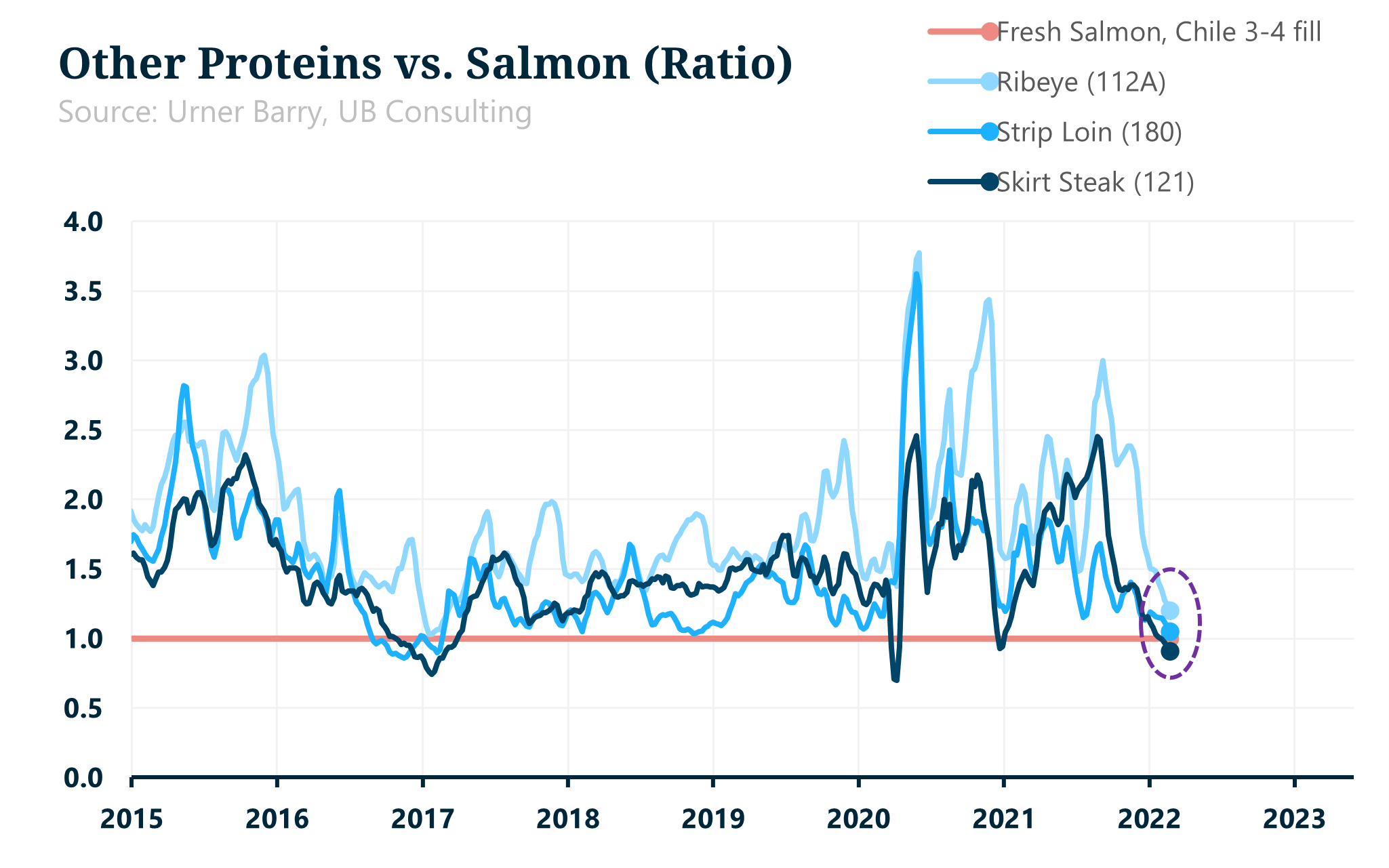

These cuts have shown a consistent slight premium over salmon. Yet, we noticed that the price spread tightened around Q2 of 2016. One reason was the negative impact on salmon harvests out of Chile caused by an algae bloom. However, salmon prices remained oscillating at a higher threshold after that, strongly suggesting a structural change in the market. As a result, the price differential between salmon and these beef items tightened until the pandemic began.

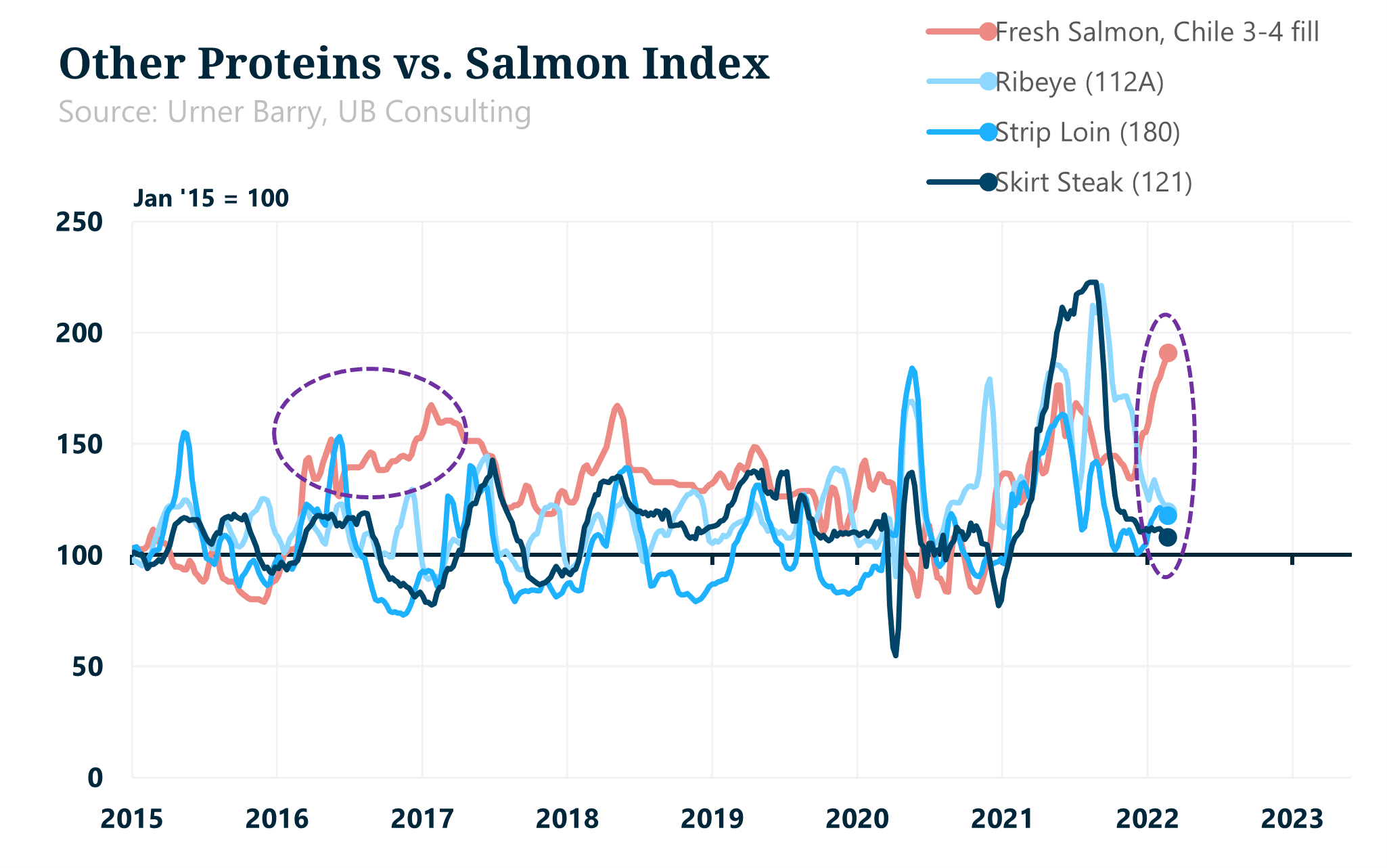

When indexed—or to look at their relative price movement over time—we notice that their behavior moves relatively in tandem with one another amid each item’s inherent seasonality. However, salmon prices are going in the opposite direction this year, allegedly due primarily to lower supplies out of Canada. At the moment, there is no import data available yet to support such a claim, but if accurate, then higher prices make sense.

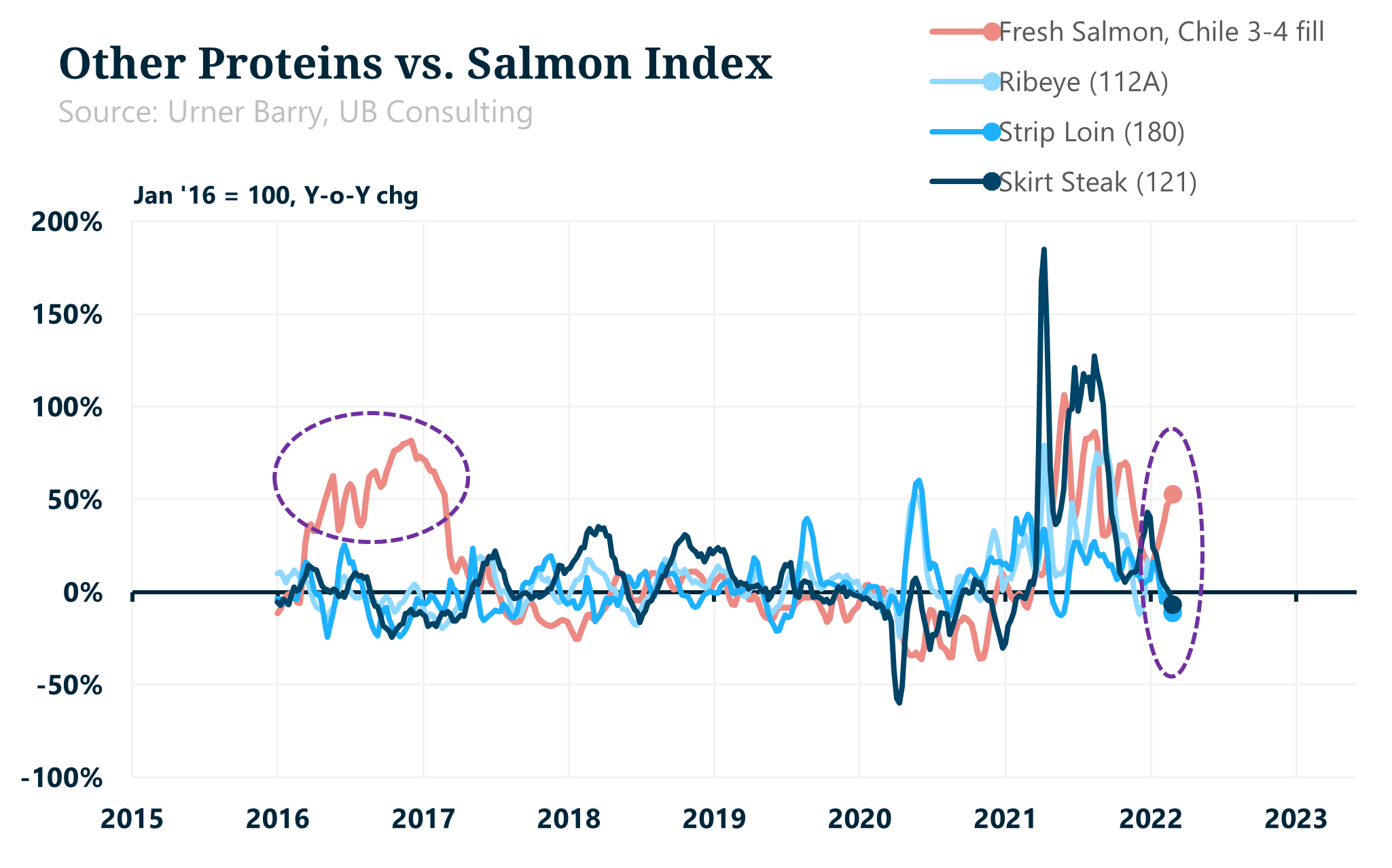

Furthermore, when indexed on a year-over-year basis, we can see a potentially similar trend in 2016 where salmon prices moved to a higher threshold. The question remains as to the potential implications in the future.

Over the last five weeks, prices for Chilean fresh salmon fillets 3-4 pounds have surpassed skirt steaks, placing prices below a 1:1 relationship for the latter. Strip loins and ribeyes are getting closer. Such a tight relationship could be attributed to lower seasonal prices for beef and record-high prices for salmon. For example, the ratio for ribeyes and salmon has not been this low since early 2017, when salmon prices also jumped at the beginning of the year.

The point is, although these price points are getting closer as beef prices correct downward—partly seasonal—and salmon prices rally to all-time highs, it is still too early to say if this is a relevant factor. Salmon prices could experience another structural change at a higher threshold as consumer habits change. As of now, retail salmon prices are only slightly higher compared to last year, while wholesale prices are up about 45 percent compared to the previous year. If sustained, price hikes to consumers are inevitable. We will pay close attention to this indicator. Whether buyers and consumers are ready to absorb such a hike before switching to another protein is hard to answer, as we mostly learn in hindsight. However, the last time this happened, salmon demand not only remained strong but prospered.

Photo Credit: aleksandr talancev / Shutterstock.com

Andrei Rjedkin

Urner Barry

1-732-240-5330 ext 293

arjedkin@urnerbarry.com

Angel Rubio

Urner Barry

1-732-240-5330

arubio@urnerbarry.com