This Week in Retail: Wrapping Up July; Digesting the Latest GDP Data

Thursday, 28 July 2022July 28, 2022

Wrapping up July, grocers are promoting fan-favorite grilling items like steaks, pork chops, and shrimp in an effort to encourage at-home cooking during the dog days of summer—a seasonally sluggish period for meat sales.

Wrapping up July, grocers are promoting fan-favorite grilling items like steaks, pork chops, and shrimp in an effort to encourage at-home cooking during the dog days of summer—a seasonally sluggish period for meat sales.

Seafood features make up nearly 33% of total protein ad volume this week, marking the fifth consecutive week that it has seized the top spot. Beef comes in second with 23%, closely followed by pork with 22%. Chicken claims 17.5% and eggs make up 1.3% of ad space, down from nearly 5% the week prior.

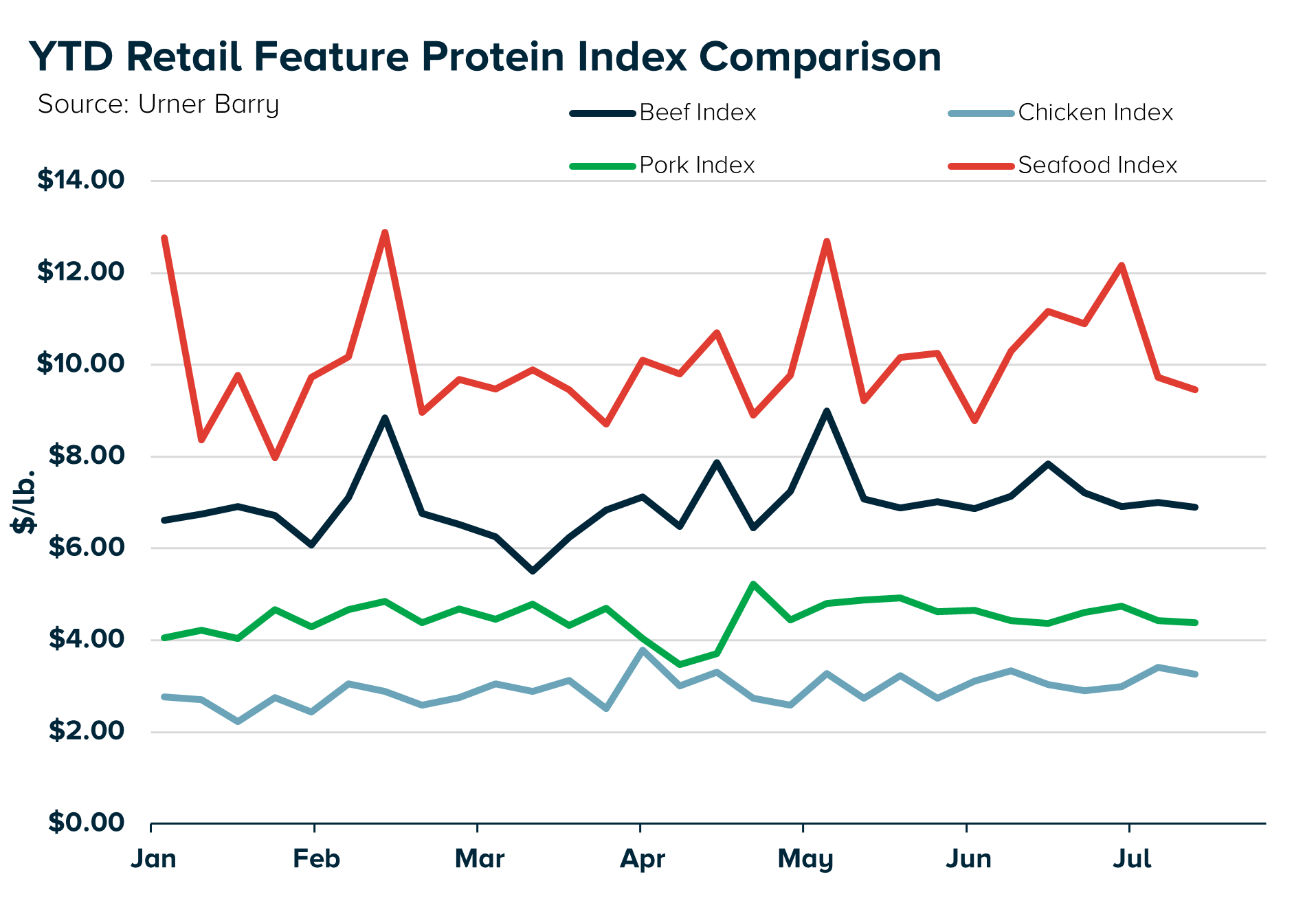

When comparing the retail features indices for the main protein categories, there is a sizable spread between seafood, beef, chicken, and pork values. Urner Barry’s Weekly Retail Index for seafood is currently at $9.46 per pound, a near seasonal all-time high. Beef averages $6.90 per pound while pork is $4.38 per pound. Chicken is $3.26 per pound.

As illustrated in the chart below, the retail feature seafood index beats out the other three proteins by a landslide. Seafood holds a 37% premium over beef and is a whopping 190% above chicken. The weekly retail feature pork index is currently 34% above chicken, but is 37% below beef and 54% under the seafood index.

Some seafood items may be pricing themselves out of the competition. Lobster tails average $36.00 per pound, up about 28% last year. Cooked shrimp averages $8.43 per pound, 5.5% higher than this week in 2021. Fillets account for most seafood features this week, with tilapia making up 20.4% and Alaskan cod claiming 15.4%. Tilapia is featured at $6.66 per pound on average, a 31% YoY increase.

Beef, the second highest-priced category, showcases a competitive grilling item—80% lean ground beef. This week, 80% lean averages $3.71 per pound, which is 24 cents above this time last year but at a discount to boneless skinless chicken breasts.

Over in pork, boneless center-cut chops average $3.26 per pound, 3 cents under 2021. Chops are some of the lowest-priced grilling items at retail this week and are likely to command attention at the meat case. Pork ribs are also an attractive option at $3.78 per pound on average, down 9 cents from the week prior. Widespread bacon features are currently priced at 7% higher than a year ago on average.

Digesting the Latest GDP Data

The Federal Reserve raised its benchmark interest rate by three-quarters of a percentage point on Wednesday in an ongoing effort to tame decades-high inflation while avoiding a recession. According to the latest CPI report, food prices rose by 1% in June, bringing the 12-month gain to 10.4%.

Real gross domestic product (GDP) decreased by 0.9 percent in the second quarter of 2022, according to the latest report released by the U.S. Bureau of Economic Analysis (BEA). This follows a 1.6 percent decline in Q1, marking the second consecutive quarter of negative economic growth in the U.S.—viewed by some economists as a recession.

However, others challenge this unofficial definition and suggest the nation is not in a recession based on a strong labor market. The National Bureau of Economic Research (NBER) defines a recession as "a significant decline in economic activity that is spread across the economy and that lasts more than a few months".

According to the BEA, disposable personal income increased by $291.4 billion, or 6.6 percent, in the second quarter. This compares to a decrease of $58.8 billion, or 1.3 percent, in the first quarter. Market observers will continue to monitor economic output in the months ahead and its impact on domestic demand and spending.

U.S. stock futures were down slightly shortly after the GDP data was released. The three major indices were sharply higher on Wednesday following the Fed's latest interest rate hike.

To view this week's feature activity along with historical retail charts, subscribers can access the complete breakdown for the various meat and poultry cuts by clicking on the Retail Features option under the 'More' tab on the Comtell homepage or click here for Urner Barry's Weekly Summary.

Photo Credit: AlexeiLogvinovich / Shutterstock.com

Courtney Shum

Urner Barry

1-732-240-5330

cshum@urnerbarry.com